America needs

more inclusive credit.

Here's why and how.

Credit Really Matters

Access to affordable credit is essential to the quality of life for American families.

70% of students who receive a bachelor’s degree borrow to fund a portion of their college expenses1

81% of new car purchases in Q1 2021 were financed2

96% of first-time buyers financed their home purchase with a mortgage3

43% of small businesses applied for a loan in 20184

30% of Americans’ monthly income on average goes towards paying off debt other than mortgages5

Access to affordable credit is essential to the quality of life for American families.

70% of students who receive a bachelor’s degree borrow to fund a portion of their college expenses1

81% of new car purchases in Q1 2021 were financed2

96% of first-time buyers financed their home purchase with a mortgage3

43% of small businesses applied for a loan in 20184

30% of Americans’ monthly income on average goes towards paying off debt other than mortgages5

Access to affordable credit is essential to the quality of life for American families.

70% of students who receive a bachelor’s degree borrow to fund a portion of their college expenses1

81% of new car purchases in Q1 2021 were financed2

96% of first-time buyers financed their home purchase with a mortgage3

43% of small businesses applied for a loan in 20184

30% of Americans’ monthly income on average goes towards paying off debt other than mortgages5

Access to affordable credit is essential to the quality of life for American families.

70% of students who receive a bachelor’s degree borrow to fund a portion of their college expenses1

81% of new car purchases in Q1 2021 were financed2

96% of first-time buyers financed their home purchase with a mortgage3

43% of small businesses applied for a loan in 20184

30% of Americans’ monthly income on average goes towards paying off debt other than mortgages5

Access to affordable credit is essential to the quality of life for American families.

70% of students who receive a bachelor’s degree borrow to fund a portion of their college expenses1

81% of new car purchases in Q1 2021 were financed2

96% of first-time buyers financed their home purchase with a mortgage3

43% of small businesses applied for a loan in 20184

30% of Americans’ monthly income on average goes towards paying off debt other than mortgages5

For more than 30 years, credit scores have determined who has access to credit and at what price.

This has created a system where millions are left out, including young adults, recent immigrants, and low-income Americans, especially those from Black and Hispanic households.

The system today leaves the majority of Americans unable to access bank-quality credit.

More than 50% of Americans would likely be declined for a bank loan, because their credit score is too low or because they have no credit score at all.

Traditionally Prime

Credit Score 730+

Traditionally Non-Prime

Credit Score 0-730

Three Digits to Rule Them All

Credit scores were innovative and useful in 1989, but they’re frozen in time.

While technology has led to dramatic improvements in information access, renewable energy, and transportation, little to no progress has been made in credit access.

Prime Credit Access vs. Other Technologies Among Americans, 1994–2020

Limitations of credit scores mean millions don’t have access to affordable credit — and millions more pay too much to borrow.

Inequities in our country are reflected in disadvantaged credit scores — particularly for Black and Hispanic Americans.

There are large disparities in distribution of credit scores among racial groups. If credit score acts as gatekeeper to good credit, disparate impact is unavoidable.

51%

20%

29%

A Better Way Forward

While not obvious at first glance, a more accurate credit model can significantly increase approval rates and reduce the cost of borrowing for consumers.

An Illustrative Example: Better Models Lead to More Access

A traditional credit-score based model will commonly approve about half of Americans, and will naturally see some level of i defaults.

The other half of Americans — viewed traditionally as “non-prime” — will have some who will i default, and a significant majority that are i creditworthy.

Yet, the traditionally "non-prime" are commonly declined as a group.

A more accurate model — such as one powered by AI — can better separate i creditworthy applicants from those likely to i default, resulting in a significantly higher approval rate overall.

Change View

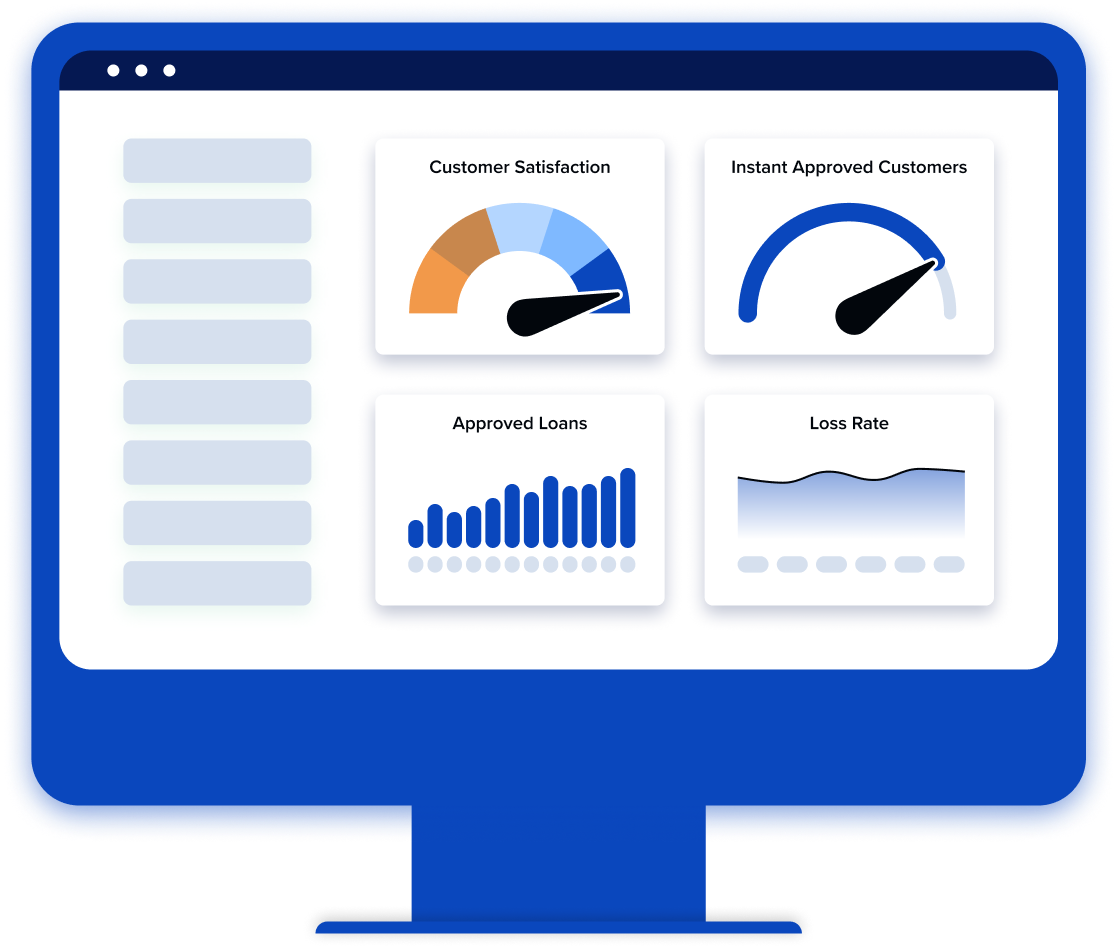

Modern credit systems, including those powered by artificial intelligence, lead to better credit outcomes — for every race, gender, ethnicity, and age group in America.

Change in Credit Outcomes by Switching to an AI-based Model

0% more Black Americans approved

0% change in APR*

Measure What Matters

While it’s reasonable to be concerned about the potential for bias in tech-enabled lending, all credit models, whether human-centric or automated, have potential for bias.

The best way to ensure fairness in credit outcomes is to establish universal standards for rigorous and transparent testing — and require it of all lenders.

ECOA was written to encourage lenders to prevent discrimination in credit transactions. All lending systems (bank loan officer, credit scores, or AI/ML-based) must be subjected to the same transparent and universal tests of fairness. ECOA does not have a carve-out for one particular three-digit number.

Several government agencies, including the White House, have released guidance on how automated systems should be designed and governed. Read our guide on these frameworks.

Modern AI lending systems can provide understandable and actionable explanations for credit outcomes, both for consumers and for lenders.

An Illustrative Example: How Certain Variables Might Impact an AI-Based Lending Decision

Probability of Repayment →

Declined

Approved

Loan Size moves the needle 12.5%.

Annual Income moves the needle 36%.

Bankruptcies moves the needle -12%.

Employer Industry moves the needle 10%.

Debt-to-Income Ratio moves the needle 24%.

No Bounced Checks moves the needle 15%.

Using advanced technology, a modern lending system can tell you the most likely reason to be declined where other systems are more opaque.

It’s Really a Win-Win

Consumers aren’t the only winners. For banks, credit unions, and other lenders, AI-based risk models offer more inclusive, resilient, and sustainable lending programs.

Together We Can Do This

Shifting to AI-driven lending models could reduce interest payments for Americans by

$0B

per year

Rapid improvement in credit access for all Americans is within reach.

If advocates and the public and private sectors work together, the result will be more than fair.

It will unlock meaningful and lasting progress for every race, gender, ethnicity, and age group in America.

Ready to get involved?

Join Us